Introduction

Feeling that knot in your stomach with college costs approaching? We’ve all been there.

Thankfully, navigating this challenge has gotten easier with the best loan app for students in India, designed specifically to lighten the financial load for students.

No more traditional bank nightmares, these apps are all about getting you that quick cash burst for tuition, books, or even that unplanned hostel fee.

In this article, we’ll run the rule over some of the best ones. They’re super user-friendly and speedier than your university’s champ sprinter when it comes to lining your pocket.

So, hang tight, we’re about to deep dive into the world of student loan apps. Trust me, it’s a game-changer!

Understanding Student Loans and Their Necessity for Students

Student loans provide an essential safety net, assisting millions of students to realize their education goals.

Fundamentally, they offer financial support for tuition, books, living expenses, and more. Want more insights about how student loans work?

Navigate to our comprehensive article and arm yourself with a thorough understanding.

Turning our attention to the need for loan apps, let’s consider a typical scenario. You’re preparing for your final semester project when suddenly, there’s an unexpected expense.

You don’t have time to wait for the lengthy traditional loan process. Enter loan apps – the friendly and fast pocket solution.

These platforms are built specifically for students. They operate on the principle of making loans accessible, understandable, and efficient.

Rather than waiting for a lengthy approval process, these apps provide instant loans right when you need them.

This moves the focus away from fretting about finances, and back onto your studies, where it truly belongs.

Stay tuned as we delve deeper into the world of student-friendly digital loan solutions. The below list is in no specific order.

List of Best Loan App for Students in India

StuCred

Interest Rate: 0% interest on loans, aiming to provide affordable financial support for students.

Processing Fee: Incorporates a non-refundable processing fee i.e. somewhere in between 6-8%, the amount of which is adjusted based on loan extensions, indicating some level of flexibility with the fee structure.

Eligibility: Main requirements include being a student from a partnered institution, completing a profile with personal and college information, and completing KYC verification, making the app accessible to a wide range of students.

Collateral: No collateral or co-signer is required, simplifying the application process and making it more attractive for students without assets or guarantors.

Application Process:

Registration: Sign up on the StuCred app.

Enter Details: Provide necessary personal and educational information.

KYC Verification: Complete the necessary KYC process.

Link VPA/UPI: To facilitate transactions and receive instant credit disbursement.

KreditBee – Flexi Personal Loan

Interest Rate: Ranges from 24% to 29.95% per annum.

Processing Fee: The processing fee ranges from ₹65 to ₹5,560.

Eligibility Criteria:

Age between 21 – 60 years.

Resident of India.

Should have a monthly source of income.

Minimum family income of ₹ 25,000.

Collateral Required: No collateral or a co-signer.

Application Process:

Registration: Registration through the app or online platform(website).

Details Submission: Provision of PAN Card and address proof (either Aadhaar or Passport).

Verification: Verification of age, residence, and income through submitted documents.

Funding Access: Direct bank transfer occurs within 5 minutes of loan application.

CASHe

Interest Rate: Fixed at 2.50% per month on the loan amount.

Processing Fees: Details to be reviewed upon application, reflecting transparent costs.

Eligibility Criteria:

Income: Open to salaried individuals earning a minimum of ₹15,000 per month.

Nationality: Must be an Indian resident.

Age: Details not provided; check with the lender.

Collateral: Loans are unsecured, with no need for security or guarantees.

Application Process:

Download & Register: Get the CASHe app and create your account.

Fill Out Application: Complete the digital form and upload mandatory documents: PAN, Address Proof, and Bank Statement.

Quick Verification: Documents are promptly verified, ensuring a smooth approval process.

Instant Fund Access: Once verified, the loan amount is disbursed directly to your bank account.

mPokket

Interest Rate: Rates vary from 0% to 4% per month (Annual Interest Rate up to 48%)

Processing Fee:

Processing & Loan Management Fees commence from Rs 50 + 18% GST (Terms & Conditions Apply).

Eligibility Criteria:

The App caters to both Students and Salaried individuals.

Collateral Required:

No. The loan process doesn’t require any collateral.

Application Process :

1. Registration: The initial step involves entering the mobile number.

Details Submission: Complete the digital form and upload mandatory documents: PAN, Address Proof, and Bank Statement.

Verification: An OTP is sent to the mobile number provided for verification.

Funding Access: Funds are instantly deposited to your bank account once approved.

Pocketly

App Name: Pocketly Loan

Interest Rate:

The Interest rate ranges from 24% – 36% p.a.

Processing Fee:

Processing Fees are 42% + service tax

Eligibility Criteria:

Age: 18 to 30 Years

Income Level: Minimum ₹15000

Employment status: Must be either salaried or self-employed.

Collateral Required:

No Collateral is required, the loan process is 100% online and does not require any paperwork or physical documentation.

Application Process:

Registration: Enter the mobile number when you download the app and fill the required basic information.

Verification: Video KYC, Verified Email ID, Address Proof (Aadhaar Card), Identity Proof (PAN Card).

Funding Access: Once successfully approved, the loan is stated to be quickly disbursed and is transferred to your bank account.

Comparison Table for Best Student Loan Apps in India

Best Loan App for Students in India is a everchanging space so these may change with time as we discover better alternatives for students.

| App Name | Interest Rate | Processing Fee | Eligibility Criteria | Collateral Required |

|---|---|---|---|---|

| StuCred | 0% | 6-8% non-refundable | Student from a partnered institution with complete KYC | No |

| KreditBee | 24% – 29.95% p.a. | ₹65 – ₹5,560 | Age 21 – 60 Years, Resident of India, Monthly Income, Family income of ₹25,000 | No |

| CASHe | 2.50%/month | Not Specified | Salaried, earning minimum of ₹15,000/month, Indian resident | No |

| mPokket | 0% – 4%/month (up to 48% ANR) | Starts from Rs 50 + 18% GST | Students and Salaried individuals | No |

| Pocketly Loan | 24% – 36% p.a. | 42% + service tax | Age 18 – 30 years, Income ≥ ₹15000, Salaried or Self-Employed | No |

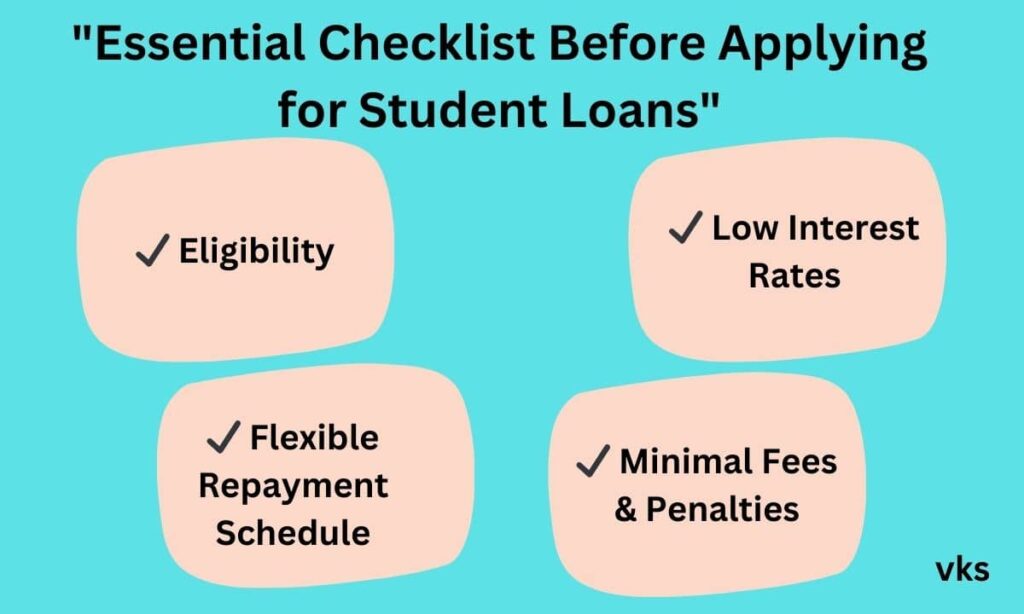

What Things To Look For While Applying For Loans For Students?

Student loans, like any financial decision, require careful consideration. Here are the critical factors you must look at:

Eligibility Criteria: First and foremost, verify you meet the loan’s application requirements.

Interest Rates: Seek loans with low interest rates. This rate directly impacts the total debt you will repay.

Repayment Schedule: Understand the loan term and frequency of repayments to manage your future finances accordingly.

Fees and Penalties: Scrutinize the fine print for any cost implications like late-payment penalties or early repayment charges.

Remember to be thorough; what appears a good deal at first glance may hide consequential costs down the line. A mindful approach can ensure your student loan is a stepping stone to your ambitions and not a burden.

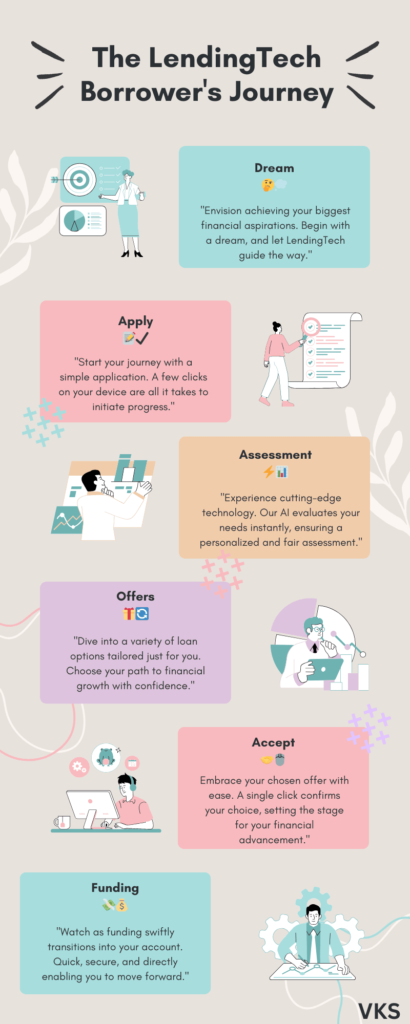

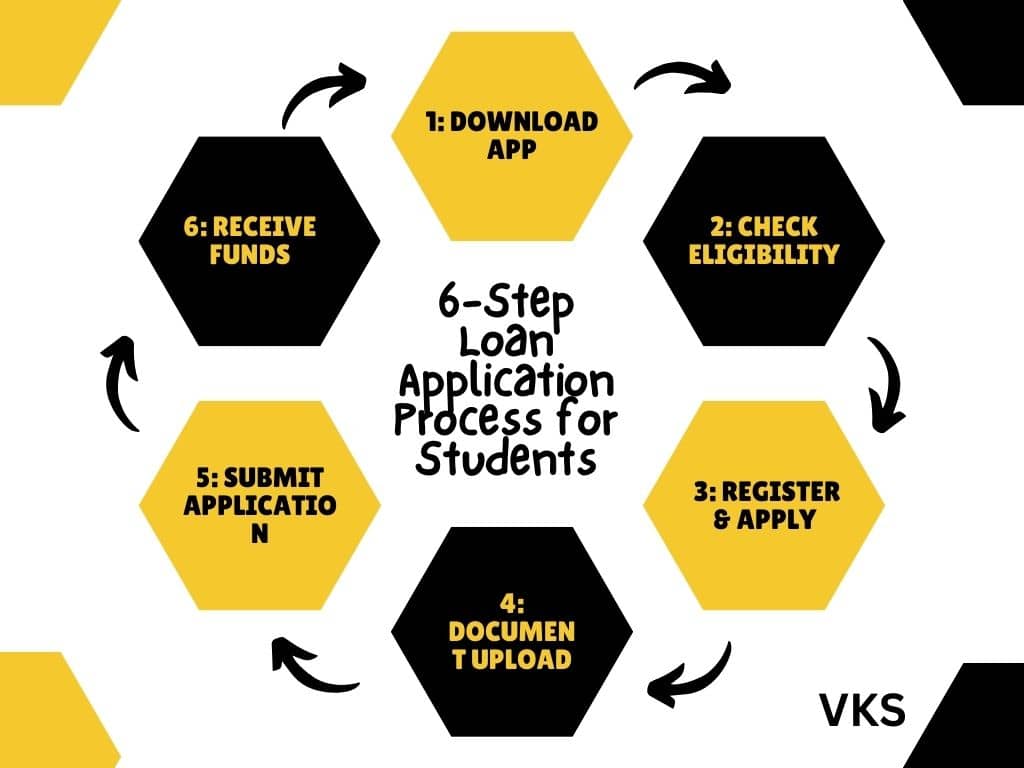

How to Apply for a Personal Instant Loan for Students Using Loan Apps

Acquiring a personal instant loan through loan apps involves a digital process that can typically be navigated in a few simple steps:

Download Loan Apps: Install loan apps designed for students from your smartphone’s app store.

Compare Options: Review the interest rates, loan terms, and fees on various apps.

Check Eligibility: Make sure you fit the loan app’s student eligibility requirements.

Register and Apply: Create an account within the app, fill in your personal and educational details as required for the loan application.

Document Upload: Upload necessary documents through the app, such as student ID, proof of enrollment, and possibly a bank statement or pay stub.

Submit Application: Submit your loan application and await a quick decision, which is a hallmark of instant loan apps.

Loan Agreement: If approved, go through the loan agreement provided in the app. Pay close attention to the repayment schedule, interest rate, and any fees.

Accept the Loan: Accept the terms within the app to finalize the loan. Funds are typically disbursed directly to your bank account.

Always ensure the app, and the lender behind it, is trusted and reputable to keep your personal and financial information safe.

To Conclude

Choosing the right loan app is about more than just speedy approvals or attractive interest rates. In the Indian context, it’s about finding an app that moulds itself around your unique educational and financial needs.

In an ocean of digital lenders, selecting the best loan app for students in India requires comprehensive research, comparison, and judicious decision-making. Any debt decision is an important one and must not be taken lightly. Investing time in understanding the loan terms, interest rates, and repayment flexibility is crucial.

After all, a loan should act as a ladder towards your educational dreams, not become a stumbling block in your financial journey.

Ready to embark on this journey of informed decision-making? Equip yourself with the necessary knowledge and tools to manage your finances effectively.

Knowledge is power, and in this case, it might just be the key that unlocks the door to your dream education without compromising your financial well-being.

2 Comments